Why Do Play Mapping – Should we bother?

The upstream oil and gas industry has learned through bitter experience and many expensive dry wells that focusing on just the “prospect” can lead to material value erosion. The evaluation of features that we drill is always a subjective process but we make better evaluations and decisions when the prospect is evaluated in its full regional context rather than the evaluation being done in relative isolation- typically on a local “postage stamp” dataset.

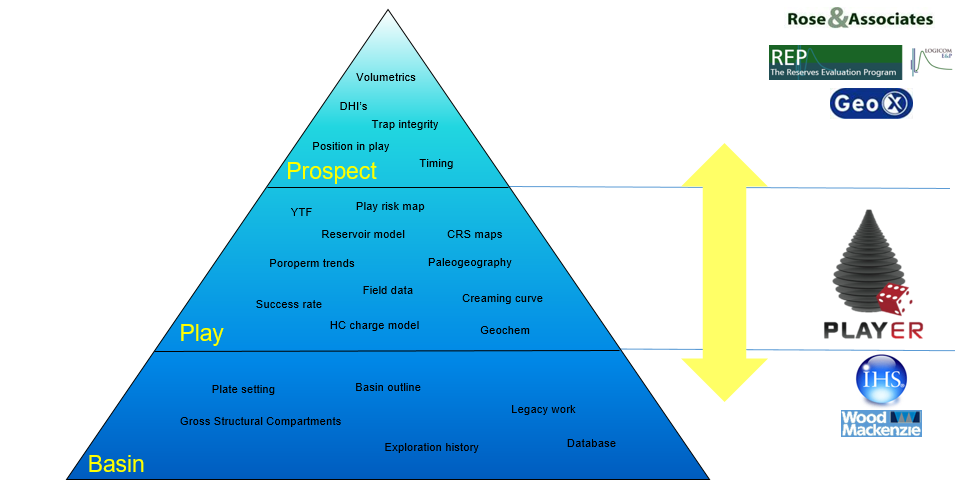

Player is designed to help companies link their regional studies to their prospect evaluations as shown below…

The play analysis process in a conventional play setting in Player forces the evaluation team to look at and understand why nearby wells have succeeded or failed and translates this and other knowledge from seismic and well data into a set of maps that helps to spatially divide any reservoir/seal pair (or play interval) into good or bad areas. This mapping process can be qualitative or quantitative and many companies have developed their own processes and workflows which we can emulate by customizing the Player software to each company. We have seen all the different play mapping types and can advise you as to their advantages and disadvantages. There is no right or wrong since the industry does not have a consensus view as to what Play Mapping actually is so we deliver what you want using your methodology and you decide – we just explain the options and choices.

One of the frequent myths that sometimes gets propagated through exploration management is that amplitude analysis or the identification of Direct Hydrocarbon Indicators (DHI’s) on seismic data will provide a magic bullet for exploration success and massive resources and funds are typically applied in larger companies towards this geophysical calibration and pursuit. Unfortunately even a cursory review of global exploration results over the last decade does not support this myth, especially in mature basins, which are the focus for most exploration teams nowadays. DHI’s (when real), are useful and valuable in frontier settings as they help de-risk the presence of material hydrocarbon charge, but they have been near useless in mature basin settings with longer exploration histories where the recent larger globally significant and material discoveries have all been non amplitude supported features pre-drill. This is because all of the amplitude supported features in these mature settings have been drilled many years ago leaving us to now look for more complex and subtle traps which are probably not amplitude supported.

Player helps the evaluation geologists in these mature areas to collate what traps types have actually been drilled and hence understand which of the remaining prospects are new trap types and which have been tried and failed. Play analysis in mature basins is much more than red, orange and green blobs and if that’s all you are doing then you can probably do a lot more and get a lot more out of your data than you previously thought. Your commercial advantage in your core exploration areas is collating and leveraging this knowledge that you have and others do not. If it’s not organized and map-based then you are not leveraging this advantage.

Exploration geologists have to collate and integrate a myriad of different data types to understand the potential of a play or basin. This includes well, seismic and map data but typically it also includes the evaluation of oil and gas shows data, charge modelling evaluations and different geochemical datasets (oil/gas analyses and typing, FIS, slick/seep data etc). The datasets vary from basin to basin but the best description to try and explain what we do is the analogy of a jigsaw puzzle. In mature basins we have most of the pieces and we have a pretty good idea of how they fit together. We have an idea of what the picture is but as we go deeper into less explored parts of the basin or even into frontier basins where there is less exploration and data then we have fewer jigsaw pieces and in many cases they are possibly mixtures of pieces from different jigsaw sets with different pictures?! Now imagine that the jigsaw pieces from multiple jigsaw sets are changing shape and form through time and it gives you some insight into what regional geologists are trying to do. We know that there is really one jigsaw but which bits do we throw away and which are useful? Play analysis helps the geologist collect and position the disparate pieces within a logical framework so that a working model can be made and prospects are evaluated in that context. Effectively this process helps separate what we actually know from what we think we know – this distinction typically gets muddled in many companies where corporate myths are taken as fact.

We do not believe any software in isolation will find you oil and gas rather it takes good people, sufficient resources, quality knowledge and databases, time, and critical focus that delivers material discoveries. However, we believe that Player will help your teams methodically sift through the data you have, hopefully collecting the nuggets that have significance, and separating them form the hyperbole that exists in minds of many people “spruking” opportunities. Player will also preserve the collected knowledge that underpins an evaluation so that it survives the departure of key team members, it can be archived and saved and then later retrieved, updated and modified as new data becomes available. The Player process is evergreen and never static in contrast to maps in a report or in a powerpoint file- these, by definition, are always out of date.