Portfolio Opportunity Ranker » GIS-PAX

What is Portfolio Opportunity Ranker? Global Yet to Find…

PORTFOLIO OPPORTUNITY RANKER- An industry first…change the way you manage your Portfolio.

Together with S&P Global we have released a brand new product ‘Portfolio Opportunity Ranker’. This unique offering provides a global interpretation of remaining commercial hydrocarbon volumes and value, and how it varies at every oil price between $20 and $200/bbl. Furthermore, you can substitute your own portfolio and evaluation criteria to customise the product and view your portfolio within this global ranking.

Our spatial volumetric tool QwikEval has been used to calculate volumes for over 22,000 prospects globally. The Portfolio Opportunity Ranker product additionally provides an estimation of the as yet unidentified prospectivity, using a calibrated AI based workflow, and integrates these and the prospects with minimum commercial cutoffs and NPV/boe value maps provided within the Portfolio Opportunity Ranker product (derived from the S&P Global Vantage© database) to deliver a global YTF and Value for every producing basin on the planet.

INFORMATION SCIENCE

Portfolio Opportunity Ranker is built solely on S&P Global spatial E&P data and is delivered on a GIS database platform with software that enables subscribers to modify all key exploration and commercial inputs and then recalculate the volumes and value calculations.

The data product provides risking and mapping evaluations for both the identified and un-identified prospectivity. The workflow is simple and industry standard. It is not a black box and is editable.

E&P INDUSTRY IS IN A TRANSITION

Decision makers in most companies are currently focussed on rapid exploration portfolio reshaping typically via divestment and M&A activities into short cycle-time, low carbon intensity opportunities.

What are the economic yet-to-find volumes in your portfolio? Where are they on a map? What does the surrounding acreage contain?

Portfolio Opportunity Ranker can be used to value the future exploration potential of an M&A target as well as better estimate the value of a farm-out / farm-in block and justify portfolio relinquishments.

It provides risking and mapping evaluations for both the identified and un-identified prospectivity. It provides Geological, Commercial and Economic YTF aggregations.

ILX = “Infrastructure Led eXploration”

– Are you actually retaining your best ILX opportunities? Are there enough nearby opportunities?

– Are there better, more valuable or lower carbon intensity ILX opportunities elsewhere that you should be accessing?

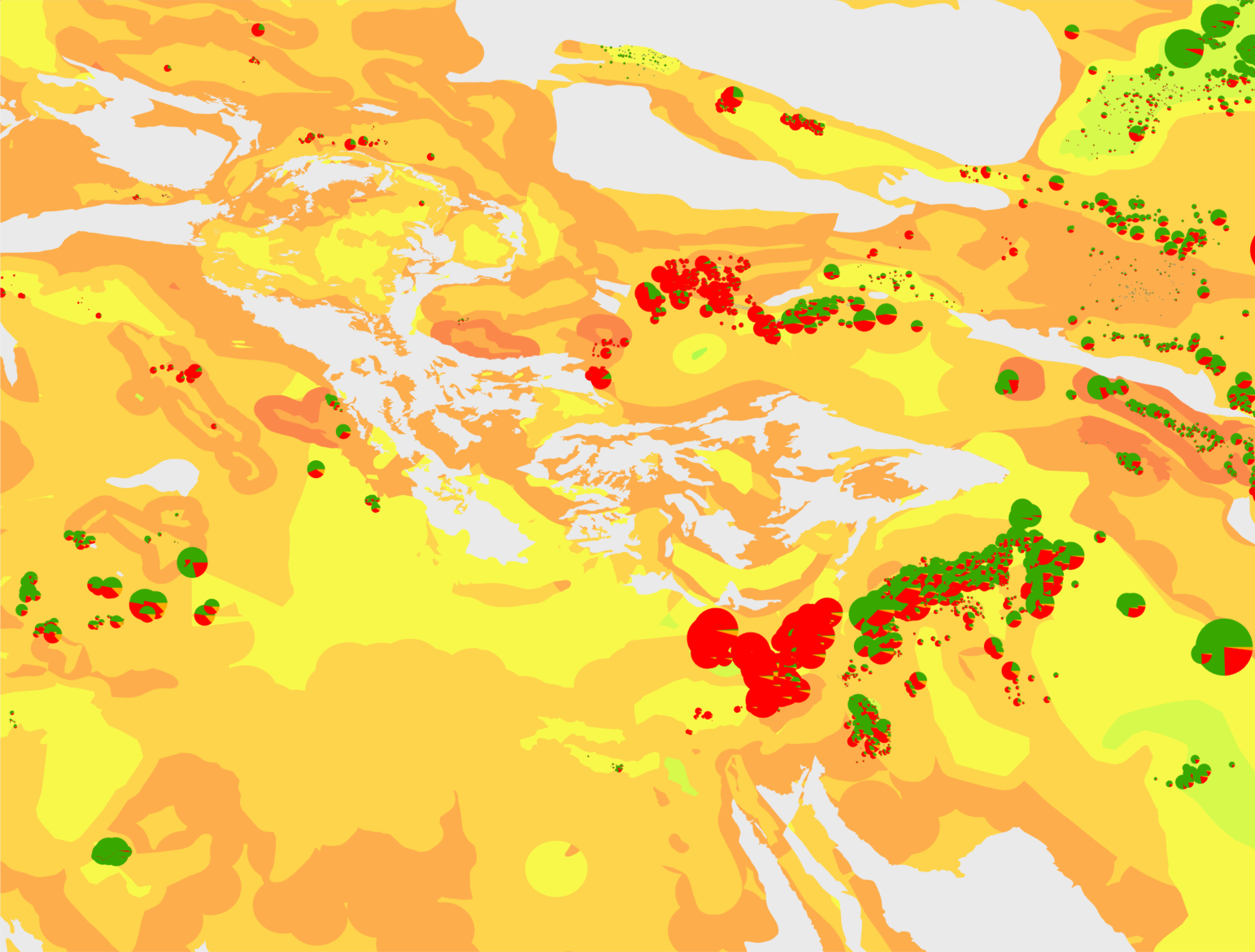

Map above is an example of an output from Portfolio Opportunity Ranker. Global probability of success map overlaid with identified prospect risked volumes. Size of pie is relative to estimated volumes & phase.